BLOG

Can I Buy a House After Bankruptcy

Hey there, Teresa Tims with TheSocalLoanPro.com answering all of your tough questions for mortgage lending in Southern California. How long do I have to wait to purchase a home after filing...

Loan Officer Assistant Job – Part Time

Loan Officer Assistant Job (Part Time) Assistant to Broker and Loan officer needed. Knowledge of the Real Estate / Loan Process is essential. This position needs 6-12 months of some kind of Real...

Loan Officer Assistant Job – Full Time

Loan Officer Assistant (Upland CA) Must have at least 1-year experience as a Jr. Loan Processor / Processor / Loan Officer Assistant / Loan Officer. Only qualified persons with relevant...

What Does Supplemental Taxes Mean

Teresa Tims TheSoCalLoanPro.com discusses this topic in an easy to understand fashion, just click on the video below. This topic is one of the biggest sources of confusion and frustration for...

How Long Do I Wait After A Short Sale To Buy A Home

Southern California a Home Loan Expert, Teresa Tims at TheSoCalLoanPro.com with California's most Trusted Mortgage Broker . Answering tough mortgage questions in Southern California since 1998. The...

How Much Money Do I Need To Buy a House in California

How much money do I need to buy a house Now that's a is a question for the ages, right!!! Check out this short video and My answer to that is.. it really depends. The first thing that you...

What does a Fed Rate Cut Mean? CA Mortgage News

What does a Fed Rate Cut Mean? CA Mortgage News As expected, the Fed cut policy rates at their most recent meeting, the second cut this year. At one time, the market was expecting a half-point cut,...

What Are Impounds or Escrow Account?

Teresa Tims, TheSoCalLoanPro.com. What Are Impounds or escrow account? Escrow account, taxes, insurance, when you hear the word "impounds" or hear the word "escrow", just think of that as your tax...

How to Refinance Smart

California's most Trusted Mortgage Broker. Teresa Tims, President of TDR Mortgage and Real Estate Group in Upland, California. TheSoCalLoanPro.com. I want to share with you how you can refinance...

How Long Do I Wait After a Bankruptcy To Buy a Home in California

Hey there, Teresa Tims, TheSocalLoanPro.com answering all of your tough questions for mortgage lending in Southern California. How Long Do I HAVE TO Wait After a Bankruptcy To Buy a Home in...

How Long Do I have to wait after a Foreclosure to Purchase

How Long Do I have to wait after a Foreclosure to Purchase Hey there, Teresa Tims, TheSocalLoanPro.com, answering all of those tough questions in mortgage lending in Southern California since...

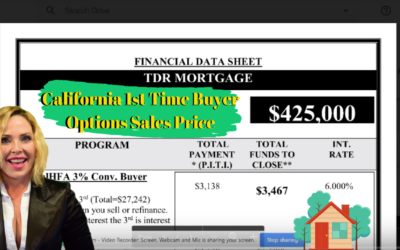

California 1st Time Buyer Options Explained for a 425K Sales Price

When you come to TDR Mortgage and you ask us, "Hey, I want to buy a house," one of the things that we do, is we evaluate all of the programs that are available to you. We break them down, and...

Jumbo Alternative Loan VS High Balance FHA Loan

Southern California a Home Loan Expert, Teresa Tims at TheSoCalLoanPro.com with California's most Trusted Mortgage Broker . TDR Mortgage is an expert when it comes to complex financing solutions....

How To Qualify for a Home Loan When You Get W2’d

Let's talk about what lenders look for when they're qualifying you for a home loan and you are a W2 wage earner. It can sometimes get complex with unique situations. If you're just somebody that...

CalHFA Drops Rates and More!! SoCal Mortgage Market News – September 2019

California's most Trusted Mortgage Broker. My name is Teresa Tims, I am President of TDR Mortgage and Real Estate Group in Upland, California. Where are we at in the real estate and mortgage market...