BLOG

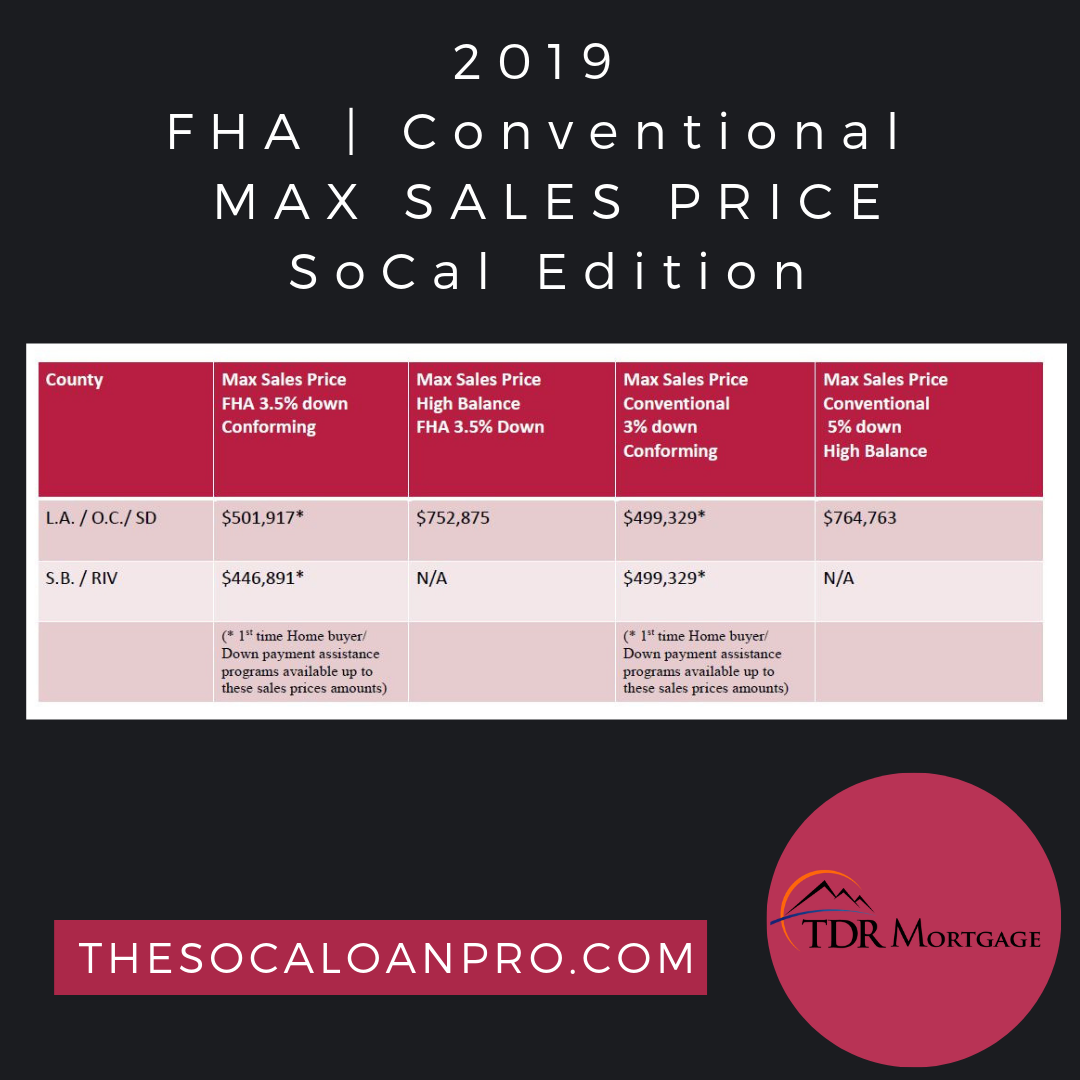

2019 Max Sales Price for FHA and Conventional home loans in SD, LA, OC, SB, & Riverside Counties

2019 Max Sales Price for FHA and Conventional home loans in SD, LA, OC, SB, & Riverside Counties. TDR Mortgage announces the 2019 loan limit revision in a easy to read format so you can have a...

2019 Max Loan Limits for FHA and Conventional home loans in SD, LA, OC, SB, & Riverside Counties

2019 Max Loan Limits for FHA and Conventional home loans in SD, LA, OC, SB, & Riverside Counties. TDR Mortgage announces the 2019 loan limit revision in a easy to read format so you can have a...

How to Qualify for a Home Loan When You Are Self Employed

How to Qualify for a Home Loan When You Are Self Employed and File a Schedule C on Your Fed Form 1040's Home Loan Expert, Teresa Tims, http://TheSoCalLoanPro discusses what lenders look for...

TDR Mortgage’s Top Tips to choosing a Real Estate Agent | California’s most trusted Mortgage Broker

Teresa's Top Tips to choosing a Real Estate Agent | California's most trusted Mortgage Broker. Teresa Tims is a 20 year mortgage & real estate veteran she shares her Top Tips to selecting a...

Best Mortgage Company Rancho Cucamonga

Hello there, and thanks for tuning into my video. The best mortgage company in Rancho Cucamonga. So you're on the web and you're searching for the best mortgage company, best lender, best loan...

Como Calificar Para Comprar Casa Si trabaja por su cuenta propia en California ( sch C)

Como Calificar Para Comprar Casa Si Trabaja Por Su Cuenta Propia en California La Experta de prestamos en California, Teresa Y su asistente Josselin Hablan de que es lo que los bancos buscan para...

Best Conventional Loans in Victorville, CA

Best Conventional Loans in Victorville, CA If you are looking for the Best Conventional Loans you need to call the Experts at TDR Mortgage. Closed Mortgage Scenario - Victorville, CA - Sales Price...

Best FHA Home Loan in Hesperia, CA

Best FHA Home Loan in Hesperia, CA To get the Best FHA Home Loan in Hesperia, CA you need to call the Best FHA Home Loan Experts at TDR Mortgage. TDR Mortgage has been closing FHA Home loans for...

Real Estate and Mortgage Market Update | So Cal Edition

Real Estate and Mortgage Market Update | So Cal Edition Hey guys, I wanted to give you a 2019 Real Estate and Mortgage Market Update. So Cal Edition. To let you know what's going on in our local So...

1st Time Home Buyer Program in California

1st Time Home Buyer Program in California Hi, my name is Teresa Tims, I'm President of TDR Mortgage in Upland, California and I serve the entire California market, and I'd like to talk to you today...

Sera mejor Refinanciar y sacar dinero de su casa o sacar un segundo préstamo California

Sera mejor Refinanciar y sacar dinero de su casa? O sacar un segundo préstamo California? Teresa Tims Presidente de TDR Mortgage en Upland CA y su asociada Josselin Hidalgo Le dicen lo que puede...

Compre Casa Sin Dinero | Fontana | Rialto | San Bernardino | Corona

Compre Casa Sin Dinero | Fontana | Rialto | San Bernardino | Corona Hipotecas en Sur De California- Teresa Tims, CA Agente Hipotecaria mas confiada Southern California Home Loans. Si ya esta cansado...

Cuanto Dinero Nesesito Para Comprar Casa ? | California | CA | Fontana

Cuanto Dinero Nesesito Para Comprar Casa ? | California | CA | Fontana Hay muchos factores que se usan para poder contestar esta pregunta de Cuanto Dinero Nesesito Para Comprar Casa ? 1. Cunto es...

Best Home Loan Company Irvine

Best Home Loan Company Irvine Well, hello there. Thanks so much for tuning in to my video. You were on the web and looking for the best home loan company in Irvine, weren't you? Well lucky you,...

Best Home Loan Lender in Southern California

Teresa Tims, the Best Home Loan Lender in Southern California, explains why consumers and Real Estate Agents should work with a Mortgage Broker, Specifically TDR Mortgage a Southern California firm...